Property Investments

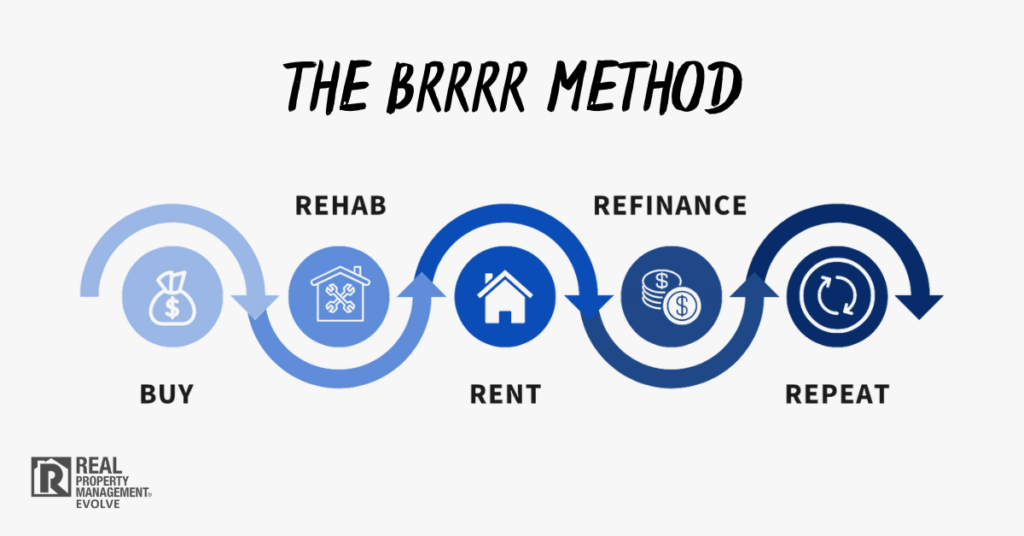

Understanding the BRRRR Method in Real Estate Investing

Seasoned investors know that there are many different strategies used to build and diversify portfolios. One is known as the BRRRR method. Some have found success with it, others not so much. But, when used correctly – many investors will tell you that it is a great way to fund further investments down the road.…

Read MoreReal Estate Property Valuation: How to Value Your Investments

When you want to invest in real estate, you want to make sure that you pay the right price. Determining what that price is is known as real estate property valuation – and it is a critical step in deciding whether or not to invest. By simply looking at the specs of a property, you are only looking…

Read MoreReal Estate vs Stocks: Why Property Investment Is a Better Alternative

If you are around investors for very long, there is a good chance that you will encounter the debate about whether real estate vs stocks are the better investment. The truth is, If you are looking to build an investment portfolio that can increase your wealth – both have the potential to make that happen.…

Read MoreInvestors Guide to Good Cap Rate in Real Estate

Learning about the cap rate in real estate, and how it relates to your property, will indicate just how profitable your investment is. [lwptoc] Cap rate is a metric often used by real estate investors to get an idea of a property’s future ROI. It is relatively simple to calculate by dividing your net operating income by the…

Read MoreRental Property Investment Strategy: Examining the Snowball Effect

Determining the right rental property investment strategy to use takes a lot of research. Let’s take a closer look at the snowball effect. [lwptoc] Investors who have been in the real estate market for years – and even those who are new to the idea – understand that there are many different types of investment…

Read MoreUnderstanding Property Classes: Class A, B, and C Property Investments

All properties are not created equal. What do property classes mean? And what does each property class mean for investors? Keep reading! [lwptoc] All properties are not created equal. Some are of higher quality – and are more highly sought than others. Some come with more risks. Others are representative of a greater return. To…

Read MoreHow to Increase Cash Flow on Rental Property

Increasing cash flow on rental property is one of the main priorities of every investor. [lwptoc numeration=”none” skipHeadingText=”Share This:”] As an investor with a portfolio of rental properties, you are going to want to take steps to maximize your cash flow at some point. After all, you need to make sure you have sufficient money…

Read More6 Tips for Building a Multifamily Portfolio

When looking to diversify your real estate investments, one of the ways to do so is by creating a multifamily portfolio. Here are 6 tips to diversify your portfolio successfully. [lwptoc numeration=”none” skipHeadingText=”Share This:”] There are many different investment options for investors looking to diversify their real estate portfolio. While they all can bring some…

Read MoreUnderstanding Real Estate Investment Loans

Choosing to opt for real estate investment loans can propel you into successful rental property investments, here is what to consider. [lwptoc numeration=”none” skipHeadingText=”Share This:”] There is no right or wrong way to get your foot in the door as a real estate investor or rental property owner. In fact, real estate investors make their…

Read MoreReal Estate Portfolio Guide: Managing Properties in 2022

This upcoming year, set up your property investments for success with this real estate portfolio guide. [lwptoc numeration=”none” skipHeadingText=”Share This:”] Long-term investing can lead to passive income and ROI, especially when it comes to rental property investments. Not only does this appear to be a great arena for investors at the moment, but it can…

Read More